Finding the right health insurance plan can be daunting, especially with the various options and complex terminology involved. If you reside in California and lack employer-sponsored health coverage, Covered California can be your gateway to affordable and comprehensive healthcare options.

This guide delves into the details of Covered California Plans 2024, their benefits, and crucial factors to consider when making this important decision.

Importance of Exploring Covered California Plans

Established in 2014 under the Affordable Care Act (ACA), Covered California is the state’s official health insurance marketplace. It acts as a central platform where individuals and families can compare and enrol in qualified health plans offered by various insurance companies.

Having health insurance is crucial for protecting yourself and your loved ones from unexpected medical expenses. Covered California plans specifically offer several advantages:

- Affordability: Through tax credits and subsidies, Covered California helps make health insurance accessible to individuals and families with varying income levels.

- Standardized Coverage: All Covered California plans comply with essential health benefits outlined by the ACA, ensuring coverage for preventive care, hospitalization, mental health services, and more.

- Choice: Individuals can choose from various plans offered by multiple insurance companies, allowing them to find a plan that aligns with their budget and healthcare needs.

Preview of the Outline

This comprehensive guide will equip you with the knowledge needed to navigate Covered California plans. We will explore:

| Chapter | Title | Description |

|---|---|---|

| 1 | Cracking the Code: Unveiling the purpose and mission of Covered California. | Understand the “who” and “why” behind this vital healthcare resource. |

| 2 | Navigating the Options: Exploring the diverse range of Covered California plans available in 2024. | Demystify the different plan categories, their features, and what sets them apart. |

| 3 | Charting Your Course: Identifying the factors that guide your ideal plan selection. | Explore coverage details, associated costs, and how they align with your specific healthcare needs. |

| 4 | Embarking on the Journey: Unveiling the enrollment process and eligibility requirements. | Learn the step-by-step process of enrolling and discover if you qualify for financial assistance. |

- Understanding Covered California plans: Definition, purpose, and the mission of Covered California.

- Types of Covered California plans available in 2024: A detailed breakdown of different plan categories and their unique features.

- Factors to consider when choosing a Covered California plan: Exploring coverage details, costs, and specific healthcare needs.

- Enrollment process and eligibility: Providing a step-by-step guide on how to enrol and determining your eligibility for financial assistance.

Understanding Covered California Plans

This guide delves into the details of Covered California Plans 2024, their benefits, and crucial factors to consider when making this important decision.

1. Definition and Purpose:

Covered California is a health insurance marketplace established by the state of California under the Affordable Care Act. It essentially acts as an online platform where individuals and families can shop, compare, and enrol in qualified health insurance plans from various insurance companies.

2. Mission of Covered California:

The mission of Covered California is to expand access to affordable health insurance for all Californians. It strives to:

- Increase the number of insured residents.

- Offer a diverse range of plan options to meet individual needs.

- Ensure transparency and fairness in the health insurance marketplace.

- Provide resources and support to assist individuals and families during the enrollment process.

By facilitating access to health insurance, Covered California aims to improve the overall health and well-being of California residents.

3. Types of Covered California Plans Available in 2024:

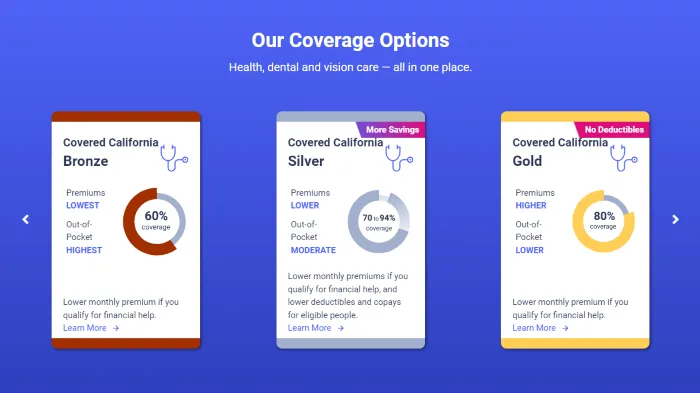

Covered California offers various plan categories, each with distinct characteristics in terms of coverage, cost, and deductibles. Here’s a breakdown of the prominent plan types available in 2024:

- Bronze: These plans have the lowest monthly premiums but come with higher deductibles, meaning you pay more out-of-pocket before the insurance plan kicks in. They are suitable for individuals or families who are generally healthy and anticipate minimal healthcare needs.

- Silver: Offering a balance between affordability and coverage, Silver plans have moderate monthly premiums and deductibles. These plans are a good option for individuals with various preventive and occasional healthcare needs.

- Gold: Gold plans come with higher monthly premiums but offer lower deductibles, resulting in less out-of-pocket expenses when seeking medical care. These plans cater to individuals or families with regular healthcare needs or seeking more comprehensive coverage.

- Platinum: These plans feature the highest monthly premiums but offer the lowest deductibles, resulting in minimal out-of-pocket costs when accessing healthcare services. Platinum plans are ideal for individuals or families with frequent healthcare needs or desiring the most comprehensive coverage available.

It’s crucial to remember that these are broad categories and individual plans within each category may vary in features and costs. Additionally, Covered California may offer additional plan options, so it’s recommended to visit the official website for the latest information.

Access to Quality Healthcare Services:

Enrolling in Covered California Plans 2024 connects you to a network of qualified healthcare providers throughout the state. This network includes doctors, specialists, hospitals, and other healthcare facilities, ensuring you have access to a wide range of medical services. You can choose a plan that allows you to select in-network providers for optimal coverage and potentially lower costs.

Financial Assistance Options for Eligible Individuals:

Covered California offers financial assistance in the form of tax credits and subsidies to help make health insurance more affordable for individuals and families with moderate incomes. Your eligibility for financial assistance depends on your household size and income level.

The Covered California website provides a financial assistance estimator tool that allows you to estimate your potential savings based on your income. By leveraging these financial assistance options, Covered California plans 2024 become accessible to a broader range of individuals and families.

Comprehensive Coverage for Various Medical Needs:

All Covered California plans adhere to the essential health benefits outlined by the ACA. This ensures coverage for a comprehensive range of medical needs, including:

- Preventive and wellness care, such as annual checkups, vaccinations, and screenings

- Hospitalization, including inpatient and outpatient care

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Laboratory services

- Pediatric services, including dental and vision care (for children under 19)

Additionally, some plans may offer additional benefits such as coverage for chiropractic care, acupuncture, or vision care for adults. It’s crucial to review the individual plan details to understand the specific services covered.

Exploring Covered California Plans 2024

Having health insurance is crucial for protecting yourself and your loved ones from unexpected medical expenses. Covered California plans specifically offer several advantages:

Overview of Plan Options for the Year 2024:

For 2024, Covered California continues to offer a diverse range of plans categorized by metal tiers: Bronze, Silver, Gold, and Platinum. Each tier offers varying degrees of coverage and cost, allowing individuals to find a plan that aligns with their budget and healthcare needs.

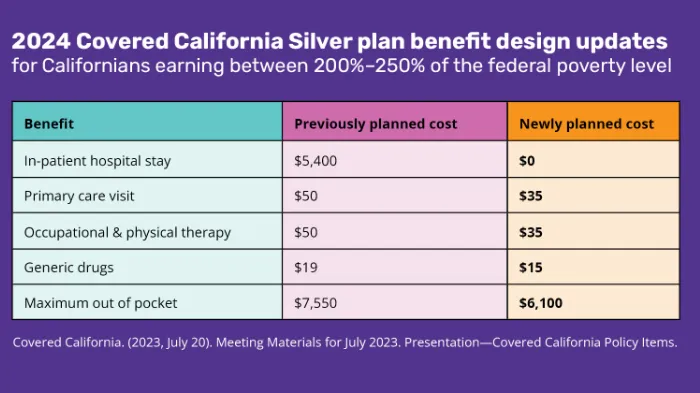

Changes and Updates Compared to Previous Years:

While the basic structure of plan categories remains consistent, Covered California may introduce adjustments to premium costs, provider networks, and specific benefits offered by individual plans each year. It’s recommended to visit the Covered California website or consult with a certified enrollment counsellor to obtain the most current information about available plans and any changes implemented for 2024.

Highlights of New Features and Benefits:

While specific details may change year-to-year, Covered California strives to continually improve the accessibility and affordability of healthcare for Californians. Here are some potential areas of improvement to consider:

- Expansion of financial assistance eligibility: This could allow more individuals and families to qualify for subsidies, making plans even more affordable.

- Introduction of new plan options with enhanced benefits: Some plans might offer additional coverage for specific healthcare needs, catering to diverse demographics.

- Integration of technological advancements: The enrollment process and accessing plan information might become even more streamlined through online tools and mobile applications.

It’s important to stay informed about any updates and announcements from Covered California to understand how these changes might impact your plan selection and enrollment process.

Coverage Options and Details

While the general structure of plan categories remains consistent across years, it’s crucial to delve deeper into the specifics of Covered California plans in 2024. This section will provide a detailed breakdown of different plan options, compare coverage levels and costs, and discuss eligibility criteria.

Detailed Breakdown of Different Covered California Plans:

As mentioned earlier, Covered California Plans 2024 offers plans categorized by metal tiers: Bronze, Silver, Gold, and Platinum. Here’s a closer look at each tier:

| Metal Tier | Monthly Premium | Deductible, Copay & Coinsurance | Ideal For |

|---|---|---|---|

| Bronze | Lowest | Highest | Generally healthy individuals/families anticipating minimal healthcare use. |

| Silver | Balanced | Moderate | Individuals/families seeking moderate coverage at an affordable price. |

| Gold | Moderate | Lower | Individuals/families anticipating more frequent healthcare use or desiring lower out-of-pocket costs. |

| Platinum | Highest | Lowest | Individuals/families requiring extensive healthcare services or preferring maximum financial protection. |

By comparing these factors through the Shop & Compare tool on the Covered California website, you can identify a plan that balances your budget with the level of coverage you need.

Comparison of Coverage Levels and Costs:

It’s important to remember that individual plans within each tier may vary in specific details. The Covered California website allows you to compare plans side-by-side based on factors like:

- Monthly premiums: This is the fixed amount you pay each month to maintain your health insurance coverage.

- Deductible: This is the amount you must pay out-of-pocket for covered services before the insurance plan starts sharing the cost.

- Copays: These are fixed amounts you may pay for specific services, such as doctor visits or prescriptions.

- Coinsurance: This is a percentage of the cost you share with the insurance company for covered services after meeting the deductible.

- Out-of-pocket maximum: This is the maximum amount you will pay out-of-pocket for covered services in a year, after which the insurance plan covers the remaining costs entirely.

By comparing these factors through the Shop & Compare tool on the Covered California website, you can identify a plan that balances your budget with the level of coverage you need.

Eligibility Criteria for Each Plan Type:

While open enrollment allows anyone to enrol in a Covered California plan, financial assistance eligibility varies based on your household income and family size. Covered California uses the Federal Poverty Level (FPL) to determine your eligibility for subsidies.

Generally, individuals and families with incomes between 138% and 400% of the FPL qualify for some level of financial assistance to help lower their monthly premiums. You can use the Financial Assistance Estimator tool on the Covered California website to estimate your potential savings based on your income.

Enrollment Process

Once you have a good understanding of the different plan options and your potential eligibility for financial assistance, you can proceed with the enrollment process. Here’s a step-by-step guide:

- Gather necessary documents: This may include proof of income, Social Security numbers for everyone applying, and immigration documentation (if applicable).

- Create an account or log in: You can create an account on the Covered California website or use an existing account if you have one.

- Complete the application: Provide your personal information, household details, and income information.

- Select a plan: Based on your needs and budget, choose a plan that best suits your circumstances. You can use the Shop & Compare tool and filters to narrow down your options.

- Estimate your financial assistance: The website will calculate your estimated savings based on your income and family size.

- Review and submit your application: Ensure all information is accurate and complete before submitting your application.

By comparing these factors through the Shop & Compare tool on the Covered California website, you can identify a plan that balances your budget with the level of coverage you need.

Important Deadlines and Dates to Remember:

Open enrollment for Covered California plans typically takes place between November 1st and January 31st of each year. This is the primary period when you can enrol or make changes to your existing plan.

Special enrollment periods are also available if you experience qualifying life events, such as losing job-based coverage, getting married, or having a baby. You have 60 days following a qualifying life event to enrol in a plan outside of the open enrollment period.

**It’s crucial to be aware of these deadlines and initiate the enrollment process well within these timelines to secure health insurance coverage for yourself and your family.

Assistance Available for the Enrollment Process:

Don’t hesitate to seek help if you find the enrollment process overwhelming or complex. Covered California offers several resources to assist:

- Online resources: The Covered California website has comprehensive information, guides, FAQs, and educational tools to help you understand your options and make informed decisions.

- Free, confidential enrollment assistance: Certified enrollment counsellors can guide you through the process, explain your options, help you compare plans, and enrol you in the most suitable plan based on your needs and eligibility. You can find local help through Covered California’s website or by phone.

- Language support: Assistance is available in multiple languages to ensure accessibility for diverse communities within California.

Additional Considerations

Beyond the basic coverage details, you might want to consider these additional factors when choosing a Covered California Plans 2024:

- Provider Networks: Ensure the plan’s network includes your preferred doctors and hospitals, especially if you have specific healthcare providers you would like to continue seeing.

- Prescription drug coverage: Look into the formulary (list of covered drugs) and associated costs for prescriptions you take regularly.

- Additional benefits: Some plans may offer benefits like vision or dental coverage. If these services are important to you, search for plans that include these benefits.

Staying Informed

Covered California updates its plan offerings, costs, and eligibility criteria each year. It’s essential to stay informed about these changes by:

- Visiting the Covered California website: Find the most current information about available plans, enrollment deadlines, and financial assistance options.

- Signing up for email updates: Receive notifications about important announcements and reminders from Covered California.

- Consulting with a certified enrollment counsellor: If you have questions or need assistance with the process, reach out to a qualified enrollment counsellor in your area.

Subsidies and Financial Assistance

Covered California offers various financial assistance programs in the form of tax credits and subsidies to make health insurance more affordable for individuals and families with moderate incomes. These subsidies help lower your monthly premium (the fixed amount you pay each month to maintain your plan) and make health insurance coverage more accessible.

Explanation of Subsidies Available for Covered California Plans:

The primary subsidy program offered through Covered California is the Advanced Premium Tax Credit (APTC).

- How it works: The APTC reduces your monthly premium based on your household income and family size. The government pays the difference between the full cost of the plan and your share (your premium after the tax credit is applied).

- Eligibility: To qualify for an APTC, your household income must fall between 138% and 400% of the Federal Poverty Level (FPL). You can use the Financial Assistance Estimator tool on the Covered California website to estimate your potential savings based on your income.

Additional Subsidies:

- Cost-Sharing Reductions (CSRs): These further reduce your out-of-pocket costs for covered services like deductibles, copays, and coinsurance. You may qualify for CSRs if your household income falls between 100% and 250% of the FPL.

Income Requirements and Eligibility Criteria:

- Your household income and family size are the primary factors determining eligibility for financial assistance.

- Covered California plans use the Federal Poverty Level (FPL) as a benchmark to determine your eligibility.

- You can find the current FPL guidelines at https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines.

- Remember, these eligibility criteria are subject to change from year to year. It’s recommended to visit the Covered California website or consult with a certified enrollment counsellor for the most current information about eligibility requirements and available financial assistance options.

By comparing these factors through the Shop & Compare tool on the Covered California website, you can identify a plan that balances your budget with the level of coverage you need.

How to Apply for Financial Assistance:

You can apply for financial assistance during the open enrollment period (typically November 1st to January 31st) or through special enrollment periods if you experience qualifying life events (e.g., job loss, marriage, birth of a child).

- Online application: Apply for financial assistance through the Covered California website during the enrollment process.

- Paper application: Request a paper application by calling Covered California plans 2024 customer service.

Managing Your Covered California Plan

Once enrolled in a Covered California plans 2024, you have access to online tools to manage your coverage effectively:

Accessing Account Information Online:

- Create an account on the Covered California website (https://www.coveredca.com/). This allows you to:

- View your plan details and benefits.

- Pay your monthly premium.

- Update your personal information.

- Track your claims history.

- Download important documents.

Reviewing Coverage Details and Benefits:

- Your online account allows you to access your plan documents, which outline the specific details of your coverage, including:

- Covered services and benefits.

- Deductible, copays, and coinsurance costs.

- In-network providers and facilities.

- You can also use the Covered California website to access plan summaries and other resources to understand your coverage better.

Making Changes to Existing Plans:

- During open enrollment or special enrollment periods, you can make changes to your existing plan, such as:

- Switching to a different plan within Covered California.

- Adding or removing family members from your plan.

- Updating your income information to reflect changes and potentially adjust your financial assistance.

Remember: Changes made outside open enrollment typically require a qualifying life event.

By utilizing the online tools and resources offered by Covered California Plans 2024, you can manage your plan effectively, track your coverage details, and update information as needed.

Renewing Your Covered California Plan

Maintaining uninterrupted health insurance coverage is crucial for accessing essential healthcare services and protecting yourself from unexpected medical expenses. This section delves into the importance of renewing your Covered California plan, the renewal process, and key deadlines to remember.

Importance of Renewing Coverage Annually

Most Covered California plans follow a yearly renewal cycle. This means you need to take specific actions to renew your coverage to ensure it remains active for the following year. Failing to renew your plan will result in loss of coverage and potential exposure to significant healthcare costs in case of unexpected medical needs.

Benefits of Timely Renewal:

- Uninterrupted access to healthcare: Renewing on time guarantees uninterrupted access to covered services and eliminates the risk of gaps in your coverage.

- Avoiding premium increases: Late renewals may result in higher premiums due to changes in your income or healthcare costs.

- Maintaining network access: Renewal ensures continued access to your plan’s in-network providers and facilities.

- Avoiding application hassles: Timely renewal allows for a seamless process compared to the potential complexities involved in re-enrolling outside the designated period.

By utilizing the online tools and resources offered by Covered California Plans 2024, you can manage your plan effectively, track your coverage details, and update information as needed.

Process for Renewing Covered California Plans:

Covered California typically sends renewal notices to enrolled members several weeks before the end of their coverage period. These notices will outline the steps and deadlines for renewing your plan. Here’s a general overview of the renewal process:

- Review your renewal notice: This document contains crucial information such as your current plan details, renewal deadline, and instructions on how to renew.

- Review your options: You can choose to renew your existing plan or explore other plan options available during the open enrollment period (typically November 1st to January 31st).

- Update your information: If your income or household size has changed, update your information to ensure an accurate determination of financial assistance eligibility.

- Submit your renewal application: Complete and submit the renewal application through the Covered California website or by contacting customer service.

Important Note: The specific steps for renewal may vary slightly depending on your circumstances. It’s recommended to follow the instructions provided in your renewal notice or consult with a certified enrollment counsellor for personalized guidance.

Deadlines and Reminders for Renewal:

- Pay close attention to the renewal deadline mentioned in your notice. Missing this deadline can result in a lapse in coverage and potential disruptions to your healthcare access.

- Set calendar reminders or schedule automated notifications to ensure you don’t miss the deadline.

- Renewing early is always recommended, as it allows sufficient time to address any issues or make adjustments to your coverage if needed.

Additional Tips for a Smooth Renewal Process:

- Gather necessary documents: Keep important documents like proof of income and Social Security numbers readily available to facilitate the renewal process.

- Seek assistance if needed: Don’t hesitate to reach out to Covered California Plans 2024 customer service or a certified enrollment counsellor if you encounter any difficulties or have questions during the renewal process.

By understanding the importance of renewing your Covered California plan, following the outlined process, and adhering to deadlines, you can ensure uninterrupted access to healthcare and maintain peace of mind regarding your health insurance coverage.